All Categories

Featured

Table of Contents

These functions can vary from company-to-company, so be certain to discover your annuity's fatality benefit functions. A MYGA can mean reduced tax obligations than a CD.

So at the extremely the very least, you pay taxes later, instead of sooner. Not just that, but the compounding passion will be based on an amount that has not already been taxed. 2. Your beneficiaries will certainly obtain the full account worth as of the day you dieand no abandonment costs will be subtracted.

Your beneficiaries can pick either to obtain the payout in a lump sum, or in a series of income settlements. 3. Frequently, when a person passes away, even if he left a will, a judge chooses who gets what from the estate as often loved ones will certainly say concerning what the will certainly ways.

It can be a long, made complex, and extremely expensive procedure. People most likely to wonderful lengths to avoid it. But with a multi-year fixed annuity, the owner has actually plainly marked a recipient, so no probate is called for. The cash goes directly to the recipient, no inquiries asked. annuities payments. If you contribute to an IRA or a 401(k) strategy, you obtain tax deferment on the profits, simply like a MYGA.

Why Would You Buy An Annuity

Those items currently provide tax deferment. MYGAs are excellent for people who desire to stay clear of the risks of market fluctuations, and desire a taken care of return and tax obligation deferral.

The insurance company spends it, normally in high quality long-term bonds, to money your future payments under the annuity. Bear in mind, the insurance company is depending not simply on your specific payment to money your annuity.

These commissions are built right into the acquisition cost, so there are no covert fees in the MYGA agreement. Deferred annuities do not charge fees of any kind, or sales costs either. Certain. In the recent environment of low rates of interest, some MYGA investors construct "ladders." That suggests buying multiple annuities with staggered terms.

Find My Annuity

If you opened MYGAs of 3-, 4-, 5- and 6-year terms, you would have an account growing every year after 3 years (purchased life annuities). At the end of the term, your money can be withdrawn or taken into a brand-new annuity-- with luck, at a greater price. You can also use MYGAs in ladders with fixed-indexed annuities, a method that seeks to maximize yield while additionally safeguarding principal

As you compare and contrast illustrations used by numerous insurer, take into account each of the locations listed over when making your final choice. Recognizing agreement terms in addition to each annuity's benefits and downsides will enable you to make the very best decision for your economic circumstance. Think thoroughly concerning the term.

Tax Deferred Fixed Annuities

If rates of interest have risen, you might desire to secure them in for a longer term. The majority of state regulations permit you at the very least 10 days to alter your mind. This is called a "complimentary appearance" period. During this time around, you can obtain every one of your refund. This ought to be prominently stated in your contract.

The firm you purchase your multi-year ensured annuity with concurs to pay you a set rates of interest on your premium quantity for your chosen period. You'll get interest attributed on a regular basis, and at the end of the term, you either can restore your annuity at an updated rate, leave the cash at a repaired account price, choose a settlement option, or withdraw your funds.

Annuity Number

Given that a MYGA offers a fixed rate of interest price that's ensured for the agreement's term, it can provide you with a predictable return. Protection from market volatility. With rates that are set by contract for a particular variety of years, MYGAs aren't based on market changes like various other investments. Tax-deferred development.

Annuities usually have penalties for very early withdrawal or surrender, which can limit your capacity to access your money without costs. MYGAs might have lower returns than supplies or common funds, which can have higher returns over the long term. Annuities usually have surrender costs and administrative expenses.

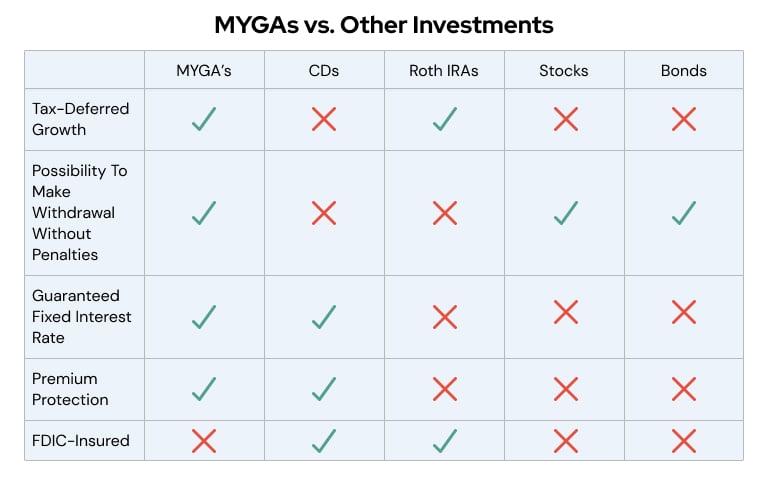

MVA is an adjustmenteither favorable or negativeto the collected worth if you make a partial surrender above the complimentary amount or fully surrender your agreement during the abandonment charge period. Inflation threat. Due to the fact that MYGAs use a set rate of return, they might not keep speed with rising cost of living gradually. Not guaranteed by FDIC.

Annuity Advertisement

:max_bytes(150000):strip_icc()/Term-a-annuity-d4d5906faea940828244ef128f416cc5.jpg)

It is very important to veterinarian the stamina and stability of the business you pick. Look at reports from A.M. Finest, Fitch, Moody's or Standard & Poor's. MYGA rates can change often based upon the economic situation, yet they're commonly more than what you would certainly earn on an interest-bearing account. The 4 kinds of annuities: Which is right for you? Required a refresher on the four fundamental kinds of annuities? Learn a lot more exactly how annuities can assure an earnings in retirement that you can't outlast.

If your MYGA has market value modification provision and you make a withdrawal prior to the term mores than, the company can readjust the MYGA's surrender value based on modifications in rate of interest - annuity default. If rates have actually boosted given that you purchased the annuity, your surrender value may lower to make up the greater rate of interest environment

Nonetheless, annuities with an ROP arrangement normally have reduced surefire rate of interest prices to counter the company's prospective threat of needing to return the costs. Not all MYGAs have an MVA or an ROP. Terms rely on the company and the agreement. At the end of the MYGA period you've selected, you have three alternatives: If having actually an assured rate of interest rate for an established variety of years still lines up with your monetary technique, you merely can restore for another MYGA term, either the exact same or a different one (if readily available).

With some MYGAs, if you're unsure what to do with the cash at the term's end, you do not need to do anything. The accumulated value of your MYGA will relocate right into a repaired account with a renewable one-year rate of interest established by the firm - fixed indexed deferred annuity. You can leave it there up until you pick your following action

While both offer ensured rates of return, MYGAs typically offer a higher rate of interest rate than CDs. MYGAs grow tax obligation deferred while CDs are taxed as income annually.

This lowers the capacity for CDs to profit from long-lasting substance passion. Both MYGAs and CDs normally have early withdrawal penalties that may affect short-term liquidity. With MYGAs, abandonment charges may apply, depending on the kind of MYGA you choose. You might not only lose interest, but additionally principalthe money you originally added to the MYGA.

Can I Sell My Pension Annuity

This means you might shed rate of interest however not the principal quantity added to the CD.Their conventional nature commonly charms extra to people who are approaching or currently in retirement. Yet they could not be best for everyone. A might be right for you if you wish to: Take advantage of an ensured rate and lock it in for an amount of time.

Gain from tax-deferred earnings development. Have the option to pick a settlement alternative for an ensured stream of earnings that can last as long as you live. As with any kind of sort of financial savings car, it is very important to thoroughly evaluate the terms of the item and speak with to determine if it's a sensible selection for achieving your individual demands and goals.

1All warranties including the death advantage repayments are dependent upon the insurance claims paying capability of the releasing firm and do not relate to the investment performance of the hidden funds in the variable annuity. Possessions in the hidden funds undergo market risks and might vary in value. Variable annuities and their underlying variable financial investment alternatives are marketed by prospectus just.

Variable Fixed Annuities

Please read it before you spend or send money. 3 Existing tax obligation law is subject to analysis and legislative change.

Entities or persons distributing this details are not accredited to give tax or lawful advice. People are motivated to seek certain guidance from their individual tax obligation or legal guidance. 4 , Just How Much Do Annuities Pay? 2023This material is intended for general public usage. By offering this content, The Guardian Life Insurance Firm of America, The Guardian Insurance Policy & Annuity Firm, Inc .

Table of Contents

Latest Posts

Highlighting Variable Annuity Vs Fixed Indexed Annuity A Closer Look at Indexed Annuity Vs Fixed Annuity Breaking Down the Basics of Investment Plans Benefits of Choosing the Right Financial Plan Why

Analyzing Strategic Retirement Planning A Closer Look at How Retirement Planning Works Breaking Down the Basics of Investment Plans Benefits of Fixed Vs Variable Annuity Pros And Cons Why Fixed Vs Var

Understanding Financial Strategies Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Pros and Cons of Various Financial Options Why Immediate Fixed Annuity V

More

Latest Posts